Compare

Business Loans

Compare offers to find the ideal loan for your needs

An online platform that helps small business owners and entrepreneurs

Users can easily view current interest rates, repayment terms, and other key loan details without needing to register.

Online loan comparison

Check current interest rate estimates — no sign-up needed.

Calculators

Calculate monthly payments, interest rates, your borrowing limit and much more…

Know Before You Borrow

Useful tips in business financing.

Why compare offers?

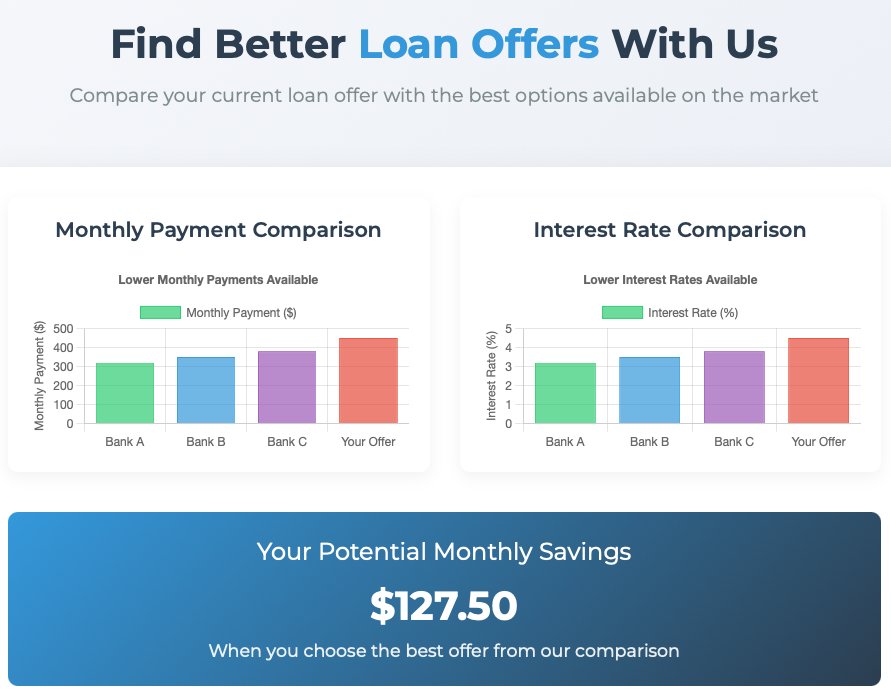

Even a small difference in APR can save you thousands over time. Our comparison tool finds the best rates from hundreds of lenders in minutes.

1000+

Loan offers compared

81%

of users found better loans than their bank offered

Check testimonials for our satisfied clients

Neque egestas congue quisque egestas diam in. Semper quis lectus nulla at volutpat diam ut venenatis.

Michael Carter

business owner

Great website for comparing business loans. All offers are clearly organized, and I quickly found the loan that suited me best.

Jessica Thompson

graphic designer

Thanks for explaining all the intricacies about rates, fees, conditions, and types of loans!

David Ramirez

co-founder

I especially appreciate the loan calculator, which helped me easily calculate how much the loan would cost.

Who We Are?

We believe every entrepreneur deserves the best financing. Compare offers to find the ideal loan for your needs.

We compare loans for businesses. To find personal loan please try another comparison tools, such as CompareMeFunds.com.

Comparison of Business Loan Products from U.S. Banks

For entrepreneurs, securing the right financing is a critical step for growth. Major national banks like JPMorgan Chase, Bank of America, Wells Fargo, U.S. Bank, and Citibank serve as primary sources of capital, each offering a suite of products tailored to different business needs. Understanding the purpose, terms, and ideal use-cases for each product is key to making an informed decision.

Core Loan Products and Their Primary Uses

- Business Term Loans:

- Purpose: This is a classic loan for a specific, one-time investment. A lump sum is provided upfront and repaid with interest over a fixed term. It’s ideal for significant expansions, large equipment purchases, acquiring another business, or a major marketing campaign.

- Typical Terms: Offered by all major banks, amounts range from $25,000 to over $500,000 with terms from 1 to 7 years for standard loans. Interest rates can be fixed or variable, with the best rates starting around 5.5% APR for highly qualified borrowers. These loans typically require a personal guarantee and are best for established businesses with a solid financial history.

- Business Lines of Credit:

- Purpose: This is the go-to product for managing cash flow fluctuations and covering short-term operational expenses. It works like a credit card: a bank pre-approves a credit limit (e.g., $10,000 to $1,000,000), and you draw only what you need, paying interest solely on the amount used. It’s perfect for covering payroll during slow seasons, purchasing inventory, or handling unexpected repairs.

- Typical Terms: Rates are almost always variable, calculated as the Prime Rate plus a margin (e.g., Prime + 2% to 10%, resulting in ~9.25% – 17.25% APR currently). They are revolving, meaning as you repay, the funds become available again. This flexibility makes them essential for ongoing operational stability.

- SBA Loans:

- Purpose: Backed by a guarantee from the U.S. Small Business Administration (SBA), these loans are a cornerstone for small businesses that might not qualify for traditional bank financing. They are used for almost any business purpose, including working capital, real estate, and equipment. They are particularly valuable for startups and younger businesses with a strong business plan but a shorter operating history.

- Typical Terms: The most common type is the SBA 7(a) loan, with amounts up to $5 million and extended terms up to 10 years for working capital and 25 years for real estate. Rates are competitive and regulated by the SBA. The application process is more documentation-intensive and slower (1-3 months) but offers greater accessibility.

- Equipment Financing:

- Purpose: As the name implies, this loan is specifically for purchasing business-critical equipment like vehicles, machinery, or technology. The equipment itself serves as collateral for the loan, which can make it easier to obtain than an unsecured loan.

- Typical Terms: Loans typically cover 80-100% of the equipment’s cost, with the term structured to match the asset’s useful life (e.g., 2 to 7 years). Approval is often faster than for a general term loan.

- Commercial Real Estate (CRE) Loans:

- Purpose: Used to purchase, construct, or renovate commercial property (e.g., office space, retail stores, industrial warehouses). This is a long-term, high-value financing solution.

- Typical Terms: Loan amounts can range into the millions, with terms from 5 to 25 years. The property acts as the primary collateral. This is a complex product requiring a significant down payment and a thorough appraisal process.

Choosing the Right Bank and Product

While all major banks offer these products, their eligibility criteria, customer service, and digital experience differ. Bank of America and Chase are known for their strong national presence and integrated online platforms. Wells Fargo has a long history in business lending, while U.S. Bank is often praised for its regional expertise and customer service.

The universal requirement is a strong personal credit score (usually 680+) and a proven track record. For most conventional products, banks require a minimum of two years in business and demonstrable revenue. Therefore, preparing detailed financial statements and a clear business plan is essential before applying. For new ventures, SBA loans offered through these banks are often the most viable path to traditional financing.

In a hurry? Get funded today

Get resources or money instantly